Virtual Series IV & Gallagher Education Month

Why Should I Care About Gallagher?

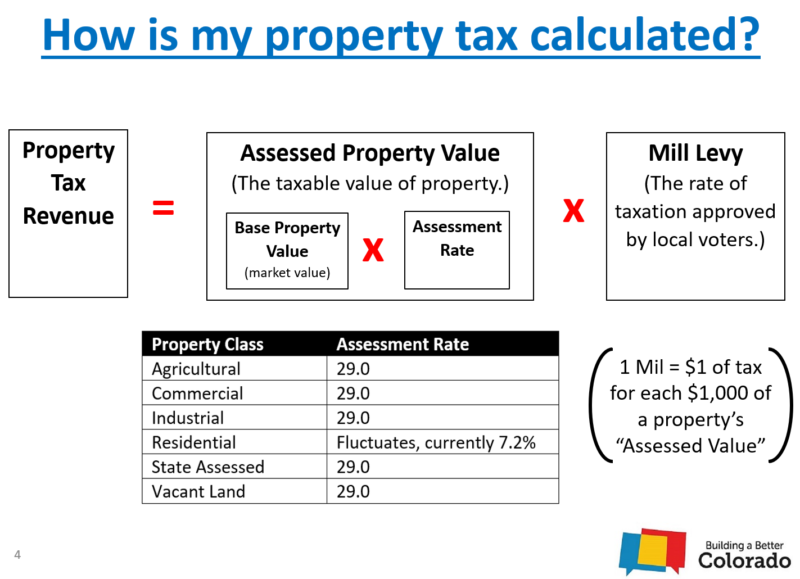

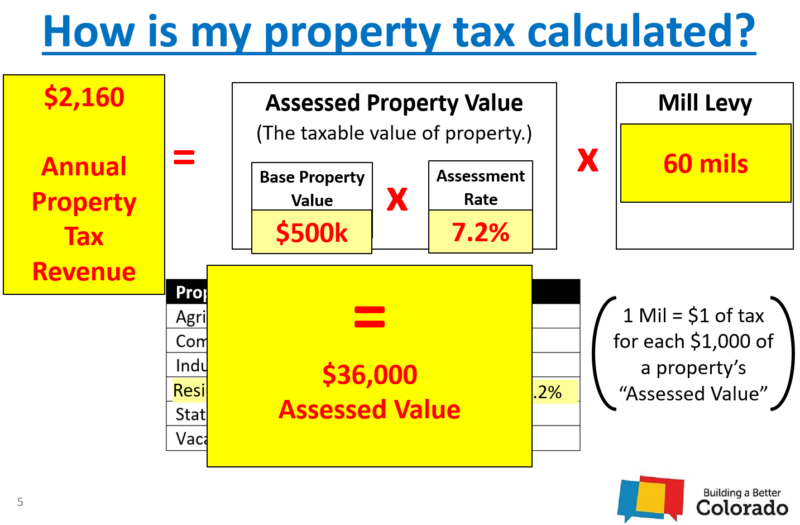

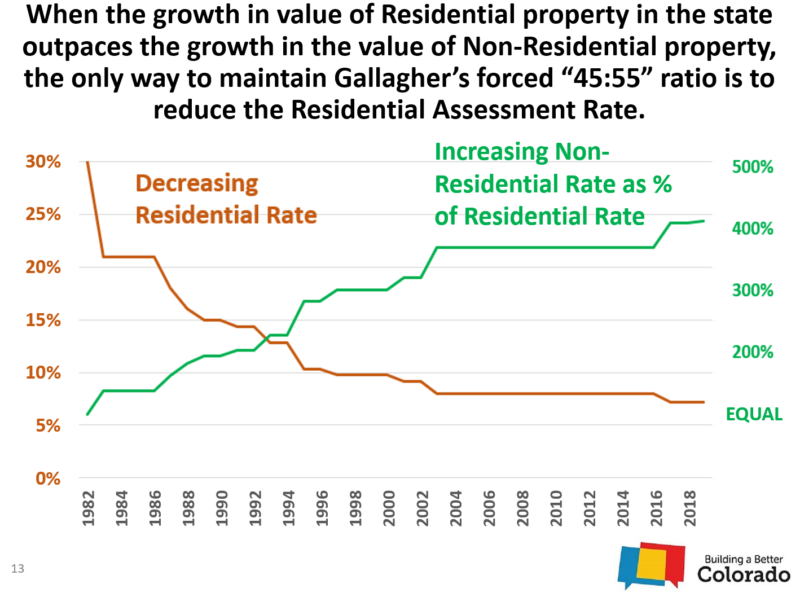

While the Gallagher Amendment was intended to address specific challenges at a specific time when it was proposed and passed in 1982, changes in real estate market conditions over time and the voters’ adoption of subsequent constitutional amendments which retroactively affect the Gallagher Amendment have created unforeseen and unintended consequences that are causing significant challenges for Colorado today.

The continual decline, or as some refer to it as the “ratcheting down effect,” of the Residential Assessment Rate has adversely impacted our communities in many ways. From disproportionately impacting our poorest communities with depressed property values, to rural areas with low rates of growth in residential property values, to the declining ability for local school districts to adequately fund K-12 education – shifting the burden from local school districts to the State. This decline often leads to local taxing authorities needing to increase their mill levy to offset the decline. This opportunity may be limited in areas of the tate struggling with depressed property values or with little Non-residential property value, such as rural areas. In this session, attendees will learn about the complexities of the Gallagher Admendment, what it means for the future of their communities post-COVID, and what the Repeal Measure is on November’s ballot.

Gallagher Education Month Session Lineup:

- Reeves Brown, Project Coordinator, Building a Better Colorado

- Carol Hedges, Executive Director, Colorado Fiscal Institute

- Chief Tj Steck, Fire Chief, Elizabeth Fire Protection District

- Leslie Colwell, Vice President – K-12 Education Initiatives, Colorado Children’s Campaign

- Sarah Mercer, Shareholder, Brownstein Hyatt Farber Schreck

- Dee Wisor, Attorney, Butler & Snow

- Joe Minicozi, Principle, Urban3

- Senator Jack Tate, District 27

- Senator Chris Hansen, District 31

- Representative Daneya Esgar, District 46

- Representative Matt Soper, District 54

Who attended? This is a FREE virtual event. Attendees included rural and urban, public and private-sector, for profit and not-for-profit, individual communities, counties and regional organizations, local and state government, chambers of commerce, universities, and private industry stakeholders and individuals.

Unintended consequences of the Gallagher Amendment has contributed to funding inequity between school districts.

35 Highest Property Wealth Districts:

- 89% have passed a mill levy override

- Average: $2,362.69 per student from 3.219 mills

35 Lowest Property Wealth Districts

- 49% have passed a mill levy override

- Average: $1,050.62 per student from 14.598 mills

For low property wealth districts, their efforts equate to 44% of the benefit at 5x the cost

Find all the information from these events & more below!

Downtown Colorado Inc. (DCI) and the Economic Development Council of Colorado (EDCC) have teamed up once again to establish and present educational content to build awareness and informed action on the Gallagher Amendment in advance of the November election as the Colorado Gallagher Amendment Repeal and Property Tax Assessment Rates Measure has made it to November’s ballot.

SEPTEMBER 2

WEBINAR: Overview of the Gallagher Amendment with Reeves Brown

Reeves Brown, Project Coordinator, Building a Better Colorado, presents a high level overview of the Gallagher Amendment and will facilitate a Q&A session with attendees.

SEPTEMBER 9

WEBINAR: How has the Gallagher Amendment Affected Rural Colorado?

A panel discussion with Dee Wiser, Butler Snow, Reeves Brown, Building a Better Colorado, Sen. Chris Hansen, Rep. Matt Soper, Rep. Denaya Esgar, moderated by Sarah Mercer, Brownstein Hyatt Farber Schreck, who discuss the unintended consequences of the statewide amendment which has adversely impacted Colorado’s rural communities.

SEPTEMBER 16

WEBINAR: EDCC’s Virtual Series: Why Should I Care About Gallagher?

PDF – Session Highlights

Presentation PDF – Reeves Brown, Gallagher Overview

Presentation PDF – Carol Hedges, Leslie Colwell, & Program Slides

While the Gallagher Amendment was intended to address specific challenges, at a specific time when it was proposed and passed in 1982, changes in real estate market conditions over time and the voters’ adoption of subsequent constitutional amendments which retroactively affect the Gallagher Amendment, have created unforeseen and unintended consequences that are causing significant challenges for Colorado today. Listen to a conversation with some of Colorado’s top fiscal policy experts who will address these challenges and possible ways to amend them.

SEPTEMBER 22 | 4:00PM

WEBINAR: DCI’s Big Talks Series: Future of Taxes + Fiscal Health

Take a deep dive into city economics, community growth, and urban design as Joe demonstrates how communities can utilize local data and simple math to gain a powerful understanding of their fiscal health, and plan for a healthy economic future.

SEPTEMBER 30 | 8:30AM

WEBINAR: The Impacts of Gallagher on our Metro Areas

A panel discussion with Dee Wiser, Butler Snow; Reeves Brown, Building a Better Colorado; Sen. Jack Tate, Rep. Matt Soper, moderated by Sarah Mercer, Brownstein Hyatt Farber Schreck, who discuss the unintended consequences of the statewide amendment which has adversely impacted Colorado’s metro areas across the state.

GALLAGHER EDUCATIONAL TOOLS:

provided by EDCC

- Gallagher Summary with Talking Points

- EDCC’s Gallagher Opinion Narrative

- Interested in submitting an opinion on behalf of your organization? We have created a template to serve as a guide: Download Template

- Talking Points for Impact on Rural Communities

RESOURCE WEBSITES TO LEARN MORE:

- EDCC – Why Should I Care About Gallagher?

- Program Highlights

- Presentations

- Videos

- Resources & Tools

- Campaign Website

- Information on the Gallagher Amendment, Ballot Info, & Endorsements

- Building a Better Colorado

- Understanding the Gallagher Amendment

- What is Amendment B on this fall’s ballot?

- 2021 Reassessment Update

- Colorado Children’s Campaign

- School Finance Reform

- Colorado Fiscal Institute

Gallagher Education Month Session Lineup:

- Reeves Brown, Project Coordinator, Building a Better Colorado | LinkedIN

- Carol Hedges, Executive Director, Colorado Fiscal Institute | LinkedIN

- Chief Tj Steck, Fire Chief, Elizabeth Fire Protection District | LinkedIN

- Leslie Colwell, Vice President – K-12 Education Initiatives, Colorado Children’s Campaign | LinkedIN

- Sarah Mercer, Shareholder, Brownstein Hyatt Farber Schreck | LinkedIN

- Dee Wisor, Attorney, Butler & Snow | LinkedIN

- Joe Minicozi, Principle, Urban3 | LinkedIN

- Senator Jack Tate, District 27 | LinkedIN

- Senator Chris Hansen, District 31 | LinkedIN

- Representative Daneya Esgar, District 46 | LinkedIN

- Representative Matt Soper, District 54 | LinkedIN

Become a Sponsor

SUPPORT OUR ECONOMIC DEVELOPMENT PROFESSIONALS TODAY!

Consider sponsoring EDCC’s Drive|Lead|Succeed Virtual Series. The support that you provide will help EDCC continue to support our professionals who serve on the front lines of the largest economic recovery the world has ever seen.

By sponsoring your organization will gain:

- An opportunity to build and reinforce strategic relationships that will be critical in our economic recovery.

- Gain key insights and knowledge on Colorado’s industry clusters, learn where opportunities lie, and how we can activate the programs and resources needed to support them.

- Access to a broad network of economic development partners from local, state, non-profit organizations, and the private sector who are the first responders to Colorado’s economic recovery.

- A cost effective way to reinforce your organization’s brand and build brand awareness among a relevant audience.

Increase marketing opportunities including visibility on EDCC’s website, webinars, and associated marketing materials.

Want to discuss our sponsorship opportunities? Contact us today to learn more.

Kim Woodworth, Operations Director | EDCC

720.260.4478 | Email Kim

2020 Virtual Series Sponsors

TITLE SPONSOR

PLATINUM SPONSOR

VIRTUAL WEBINAR TITLE SPONSOR

EDIE AWARDS TITLE SPONSOR

SILVER SPONSOR

VIRTUAL SERIES PARTNER

VIRTUAL SERIES SUPPORTER

MEDIA SPONSOR